Political risk assessment or analysis is a method of weighing the various political, economic, social, and cultural factors that must be taken into consideration when deter mining the feasibility of engaging in an endeavor, usually economic, in any country. Political risk assessment is often undertaken by entities, corporations, and organizations that would like to engage in operations in other countries with endeavors such as a multinational corporation planning to make a direct investment in a developing country. Analysis is done on the basis of factors that may be responsible for a sudden change in the stability of a nation that could lead to business losses.

Political risks are defined as any changes in the political environment that may adversely affect the value of a firm’s business activities. Risk may imply the nonexistence of established order. It may also mean having some semblance of order but with a high probability of change. Or, it can mean a high level of stability and established order but with some probability of government intervention through expropriation or nationalization. The analysis of risks usually requires acquiring a quantity of data about a country’s historical, political, economic, social, and cultural performance; this often requires time necessary to process such data into some meaningful assessment of the direction in which a nation is going. Corporations operating abroad usually try to avoid risk or shift the burden of that risk.

Types Of Risks

In general, there are two broad types of risks: macro political risks that affect all firms, entities, or organizations in the country, and micro political risks that affect only a specific firm or firms in a specific industry in the country. There are also three categories of political risk of major importance to businesses. The first is ownership risk, occur ring when confiscation or expropriation threatens the firm’s property. The second type is operating risk, occurring when changes in laws, environmental standards, tax codes, terrorism, insurrection, or other shifts threaten the ongoing operations of the firms or safety of employees. The third type of risk is transfer risk, occurring when government interference with the firms curtails the ability to shift funds into and out of the country; this results from governmental action such as passage of laws that expropriate private property, raise operating costs, devalue the currency, or constrain the repatriation of profits.

Nongovernmental actions such as kidnapping, extortion, and acts of terrorism bring risk to any business endeavor as well. In fact, a broader list of examples of political risks also include nationalization or confiscation, campaigns against foreign goods, mandatory labor benefits legislation, and other forms of violence resulting from civil war, insurrection, or rebellion. In addition, there are also “hidden risks,” which include cronyism, organized crime and fraud, unfair competition, counterfeiting and piracy, corruption, poor legal standards, and cultural differences. Beyond the risks themselves, the set of effects that result is most significant, such as the loss of profits or assets, increased costs, loss of sales, and decreased productivity.

Measuring Risk

There are objective measures for identifying risk factors, but there are subjective measures as well. There are several approaches for evaluating and forecasting the existence of risk. One is the grand tour, which relies on the opinion of company executives visiting the country where the investment is being considered. In this method, the analyst engages in selectivity of information required to gauge risk. A second approach is the old hands approach, which depends on the advice of an outside consultant, serving as the expert whose input provides the basis for risk assessment. Another approach is the Delphi technique, which combines the views of independent experts who use various sets of indices and analysts in determining risk. It can use existing data from the Human Development Index, the Globalization Index, the Corruption Index, and the Freedom Index in determining a nation’s level of risk.

Quantitative methods, such as multivariate analysis, can also serve as a means to assess risk. However, most analysts indicate preference for an integrated approach that systematically uses qualitative and quantitative dimensions. For example, the Eurasia Group produces a Global Political Risk Index that can be found in publications such as The Economist. Another company that offers political risk analysis is Political Risk Services, which uses a 100-point scale and rates a country on the basis of three factors: 50 points for politics, 33 points for economics, and 17 points for society.

Many different independent dimensions influence a nation’s political destiny, including domestic instability, foreign conflict, political climate, and economic climate. Politically, a nation needs to ensure leadership success to avoid crisis. There are several factors that can undermine political success in any country: the erosion of middle-class support for the regime, corruption, work stoppages, ideology or religion, the likelihood of civil disorder and terrorism, military unrest, border disputes, and social revolution. Based on these dimensions and factors, a nation’s risk rating can be any of the following: “very high,” meaning it will happen; “high,” meaning it could occur in the short-term; “very possible,” meaning there is a likelihood of it happening; “possible,” meaning there is a 50 percent chance of the scenario occurring; “low,” meaning there is little chance of occurrence; and “very low,” indicating an unlikely occurrence.

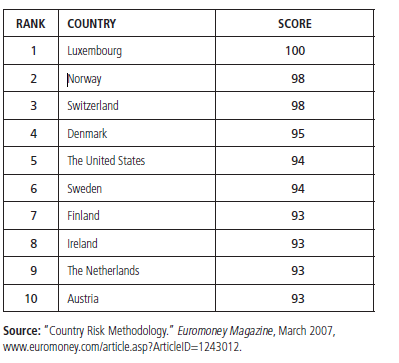

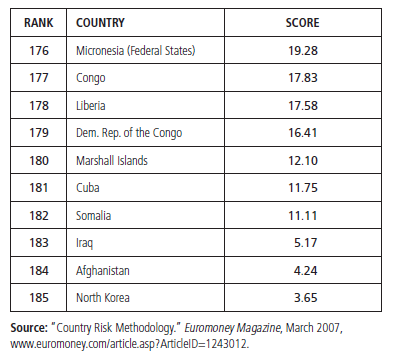

According to one method of assessing country risk, Table 1 and 2 show the top ten countries with the least risk and the bottom ten countries that pose the greatest risk.

Table 5: Top Ten Countries, Country Risk Ranking And Overall Country Risk Index (As Of September 2006)

Table 6: Bottom Ten Countries, Country Risk Ranking And Overall Country Risk Index (As Of September 2006)

Political risk analysis thus examines the possibility that political decisions, events, or conditions in a country, including those which may be referred to as social, will affect the economic environment in such a way that investors would lose money or have a reduced profit margin. The results of such an assessment can determine whether a company, entity, or organization will decide to operate in a particular country based on these factors.

Bibliography:

- “Country Risk Methodology.” EuroMoney Magazine, March 2007, www. euromoney.com/article.asp?ArticleID=1243012.

- Dickson, Douglas. Managing Effectively in the World Marketplace. New York: Wiley, 1983.

- Griffin, Ricky W., and Michael W. Pustay. International Business: A Managerial Perspective. 2nd ed. Reading, Mass.: Addison-Wesley, 1999

- Harms, Philipp. International Investment, Political Risk and Growth. Boston: Kluwer Academic, 2002.

- Henisz,Witold Jerzy. Politics and International Investment: Measuring Risk and Protecting Profits. Cheltenham, U.K.: Edward Elgar, 2002.

- “Historical Country Risk Ratings.” Euromoney Magazine, September 2006, www.euromoney.com/article.asp?ArticleID=1080477&LS=wikiCRh.

- Perkins, Peter. “Country Risk Poll March 2007: Global Economy Deals with Worries amidst the Prosperity.” Euromoney Magazine, March 2007, www.euromoney.com/Article/1242102/Title.html.

- Poole-Robb, Stuart Bailey, and Alan Bailey. Risky Business: Corruption, Fraud, Terrorism, and other Threats to Global Business. London: Kogan Page, 2002.

- Rogers, Jerry. Global Risk Assessments: Issues, Concepts, and Applications. Book 2. Riverside, Calif.: Global Risk Assessments, 1986.

This example Political Risk Assessment Essay is published for educational and informational purposes only. If you need a custom essay or research paper on this topic please use our writing services. EssayEmpire.com offers reliable custom essay writing services that can help you to receive high grades and impress your professors with the quality of each essay or research paper you hand in.

See also:

- How to Write a Political Science Essay

- Political Science Essay Topics

- Political Science Essay Examples